From my family to yours, I want to wish you a VERY Merry Christmas and a Happy New Year! I look forward to connecting with you all again after the holidays. Here’s to an amazing 2017!

You Can Save for a Down Payment Faster Than You Think!

Interest rates are still at record lows, but they are climbing and predicted to rise further by the end of 2017. Rising rates, increasing home values, and stricter lender requirements can make the home buying process challenging for many. An additional challenge for buyers is saving the funds necessary for a down payment. In a study conducted by Builder.com, researchers determined that nationwide, it would take “nearly eight years” for a first-time buyer to save enough for a down payment on their dream home.

Depending on where you live, median rents, incomes, and home prices all vary. By determining the percentage of income a renter spends on housing in each state, and the amount needed for a 10% down payment, Builder.com was able to establish how long (in years) it would take for an average resident to save.

According to the study, residents in South Dakota are able to save for a down payment the quickest in just under 3.5 years. Below is a map created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of the Freddie Mac or Fannie Mae 3% down programs? Suddenly saving for a down payment no longer takes 5 or 10 years, but becomes attainable in under two years in many states as shown in the map below.

Bottom Line

A great lender can help you determine your purchasing power, what type of loan you are eligible for, and what kind of down payment you will need. And a professional financial advisor can help you create a plan to budget, save, and invest in your dream home. Whether you have just started to save for a down payment (or have been for years) you may be closer to your dream home than you think. And when you’re ready, I would be delighted to help you find that dream home and make it your own! As always, if you have questions or would like additional information, please don’t hesitate to ask. I’m here to help!

Why Are Mortgage Interest Rates Increasing?

According to Freddie Mac, “Mortgage Rates Hit New 2016 High.”

“The 10-year Treasury yield dipped this week following the release of the Job Openings and Labor Turnover Survey. The 30-year mortgage rate rose another 5 basis points to 4.13 percent, starting the month 18 basis points higher than this time last year. As rates continue to climb and the year comes to a close, next week’s FOMC meeting will be the talk of the town with the markets 94 percent certain of a quarter-point-rate hike.

- 30-year fixed-rate mortgage (FRM) averaged 4.13 percent with an average 0.5 point for the week ending December 8, 2016, up from last week when it averaged 4.08 percent. A year ago at this time, the 30-year FRM averaged 3.95 percent.

- 15-year FRM this week averaged 3.36 percent with an average 0.5 point, up from last week when it averaged 3.34 percent. A year ago at this time, the 15-year FRM averaged 3.19 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.17 percent this week with an average 0.5 point, up from last week when it averaged 3.15 percent. A year ago, the 5-year ARM averaged 3.03 percent.”

Why did rates go up?

Whenever there is a presidential election, there is uncertainty in the markets as to who will win. One way that this is noticeable is through the actions of investors. In an election year, as we get closer to the first Tuesday of November, many investors pull their funds from the more volatile and less predictive stock market and instead, choose to invest in Treasury Bonds.

When this happens, the interest rate on Treasury Bonds does not have to be as high to entice investors to buy them, so interest rates go down. Once the elections are over and a President has been elected, investors return to the stock market and other investments, leaving the Treasury to raise rates to make bonds more attractive again.

Simply put, the better the economy, the higher interest rates will go. For a more detailed explanation of the many factors that contribute to whether interest rates go up or down, you can follow this link to Investopedia.

The Good News

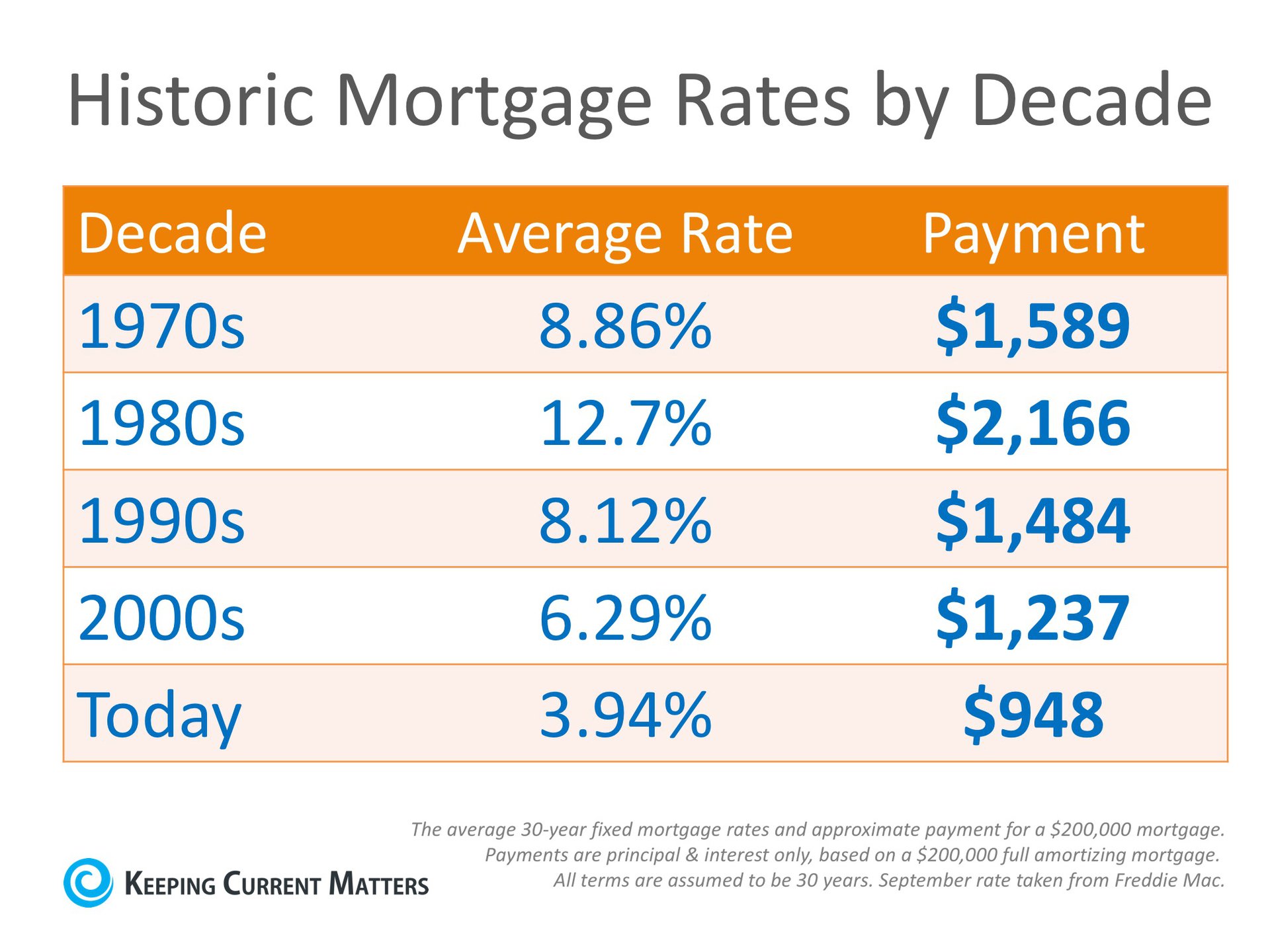

The good news is that even at slightly over 4%, rates are still significantly lower than they have been over the last 4 decades, as you can see in the chart below. And buying is still significantly less expensive than renting!

Any increase in interest rates will impact your monthly housing costs when you secure a mortgage to buy your home. A recent Wall Street Journal article points out that, “While still only roughly half the average over the past 45 years, according to Freddie Mac, the quick rise has lenders worried that home loans could become more expensive far sooner than anticipated.”

Tom Simons, a Senior Economist at Jefferies LLC, touched on another possible outcome for higher rates:

“First-time buyers look at the monthly total, at what they can afford, so if the mortgage is eaten up by a higher interest expense then there’s less left over for price, for the principal. Buyers will be shopping in a lower price bracket; thus demand could shift a bit.”

Bottom Line

Interest rates are impacted by many factors, and even though they have increased recently, rates would have to reach 9.1% for renting to be cheaper than buying. Rates haven’t been that high since January of 1995, according to Freddie Mac. As always, if you have questions, please feel free to ask. I’m here and happy to help!

Why Waiting Until After the Holidays to Sell Isn’t a Smart Decision

Every year at this time, many homeowners decide to wait until after the holidays to put their home on the market for the first time, while others who already have their homes on the market decide to take them off until after the holiday season. Here are seven great reasons not to wait:

- Relocation buyers are out there. Neither corporations nor the military are concerned with holiday time, and if the buyers have kids, they want to get moved and get them into school as quickly as possible.

- Purchasers that are looking for a new home during the holiday season are serious buyers and are ready to buy.

- You can restrict the showings on your home to the times you want it shown. You remain in control.

- Homes often show better when decorated for the holidays.

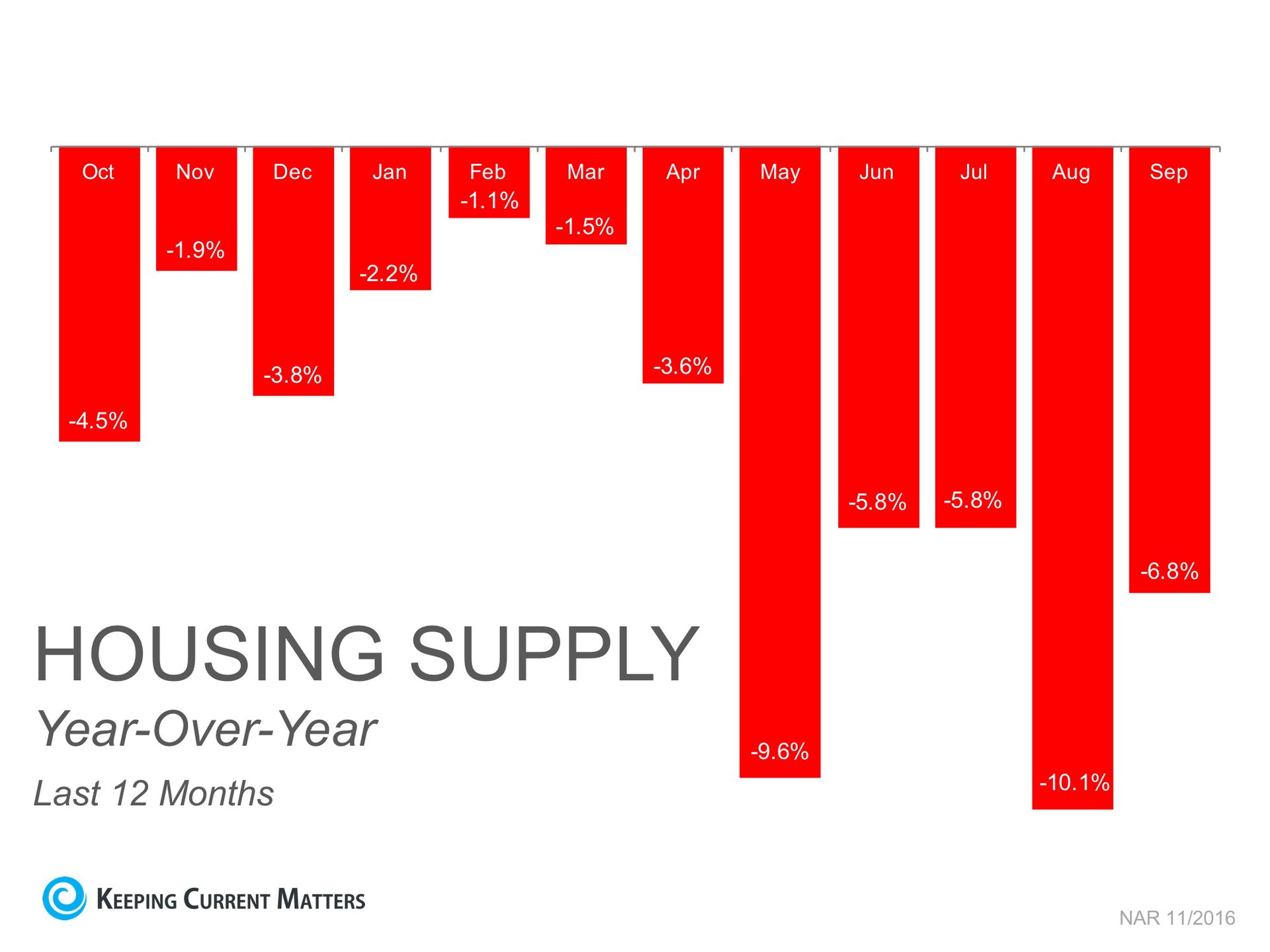

- There is less competition for you as a seller right now. The supply of listings increases substantially after the holidays, directly increasing your competition. Let’s take a look at listing inventory as compared to the same time last year:

- In many parts of the country, new construction will continue to surge as we move forward, reaching new heights in 2017. New housing starts will likely lessen the demand for your home.

- And finally, changes in the market have caused a recent rise in mortgage interest rates. Should rates continue to go up, this could negatively impact the existing pool of buyers, decreasing the demand for homes. Don’t wait until this happens!

Bottom Line

Waiting until after the holidays to sell your home really doesn’t make sense. And, as always, if you’d like more information or if I can answer any questions for you, please don’t hesitate to ask. I’m here to help!

A Lack of Listings Remains a ‘Huge’ Challenge in the Market

The housing crisis is finally in the rearview mirror as the real estate market moves down the road to a complete recovery. Home values are up, home sales are up, mortgage rates remain low, and distressed sales (foreclosures & short sales) are at their lowest mark in over 8 years nationwide. This year has been, and next year should prove to be, great for real estate. However, there is one thing that may cause the industry to tap the brakes moving forward: a lack of housing inventory. According to the National Association of Realtors (NAR), buyer traffic and demand continues to be the strongest it has been in years. The supply of homes for sale has not kept up with this demand, and lack of supply has driven prices up in many areas as buyers compete for their dream home. This is certainly true in Kitsap County!

Traditionally, the winter months create a natural slowdown in the market. Jonathan Smoke, Chief Economist at realtor.com, points to low interest rates as one of the many reasons why buyers are still out in force looking for a home of their own.

“Overall, the fundamental trends we have been seeing all year remain solidly in place as we enter the traditionally slower sales season, and pent-up demand remains substantial as buyers seek to get a home under contract while rates remain so low.”

NAR’s Chief Economist, Lawrence Yun, points out that the inventory shortage we are currently experiencing isn’t a new challenge by any means:

“Inventory has been extremely tight all year and is unlikely to improve now that the seasonal decline in listings is about to kick in. Unfortunately, there won’t be much relief from new home construction, which continues to be grossly inadequate in relation to demand.”

The recent election did cause a small uptick in mortgage rates as funds were pulled from bonds and moved into stocks, but rates still remain at historic low levels and should continue to remain low for some time to come. Low rates will continue to create a climate favorable to buyers and keep demand strong. So far I am seeing no decline in numbers of buyers even in the face of declining inventory.

Bottom Line

Healthy labor markets and job growth have created more and more buyers who are not just ready and willing to buy but are also able to do so. If you are debating whether or not to put your home on the market, NOW is the time. Buyers are actively looking, and yours may be just the home they’ve been waiting for!

As always, if you have questions or would like more information, feel free to ask. I’m here to help!

5 Traits to Look for in Your Agent

While thinking about how I can best serve my clients, I ran across this article on Trulia that shares some great ways to choose an agent. A good agent goes a long way toward securing that home of your dreams!

“In this internet era, we’ve gotten to a place where we require all of our information in bite-sized, white-and-charcoal grey pieces. But when it comes to creating interpersonal and professional relationships that really work, lists of interview questions and “what to Google” articles can fall short of fully fleshing out the factors that make us mesh with someone.

So let’s go a little deeper. Picking a real estate agent is a business and a relationship challenge – one which has a potentially massive impact on your finances and future enjoyment of the place you and your family live. If you take that seriously, here are a handful of characteristics I recommend you look for as you evaluate prospective agents.

- Creativity. Some transactions go precisely as planned, clicking right along on schedule. Others – many others – get messy:

- the loan underwriter issues bizzaro, last-minute document demands

- the appraisal comes in low

- the buyer backs out

- you see 50 homes without any winners, or

- the inspection reports reveal issues that make you wonder whether the home is a diamond in the rough or a money pit.

Whether your transaction will be easy-peasy or uber-messy, you cannot know until you’re in it. When you’re agent-hunting, it behooves you to look for someone who has the experience and creative problem-solving skill to help you methodically think through the facts, surface alternatives, propose solutions and engineer obstacle workarounds – just in case the going gets tough.

- Deep, varied expertise. Buying or selling a home is much more of a lifestyle design experience than it is a financial transaction, truth be told. To do it with results that work well for yourself, your family and your finances for the duration, you need an agent that’s an eager partner with you. One that will deep-dive into all the nooks and crannies of your aesthetics, your psychology, your life plans, your financials and even your relationship dynamics.

You also need an agent with deep – not surface – understanding of homes, neighborhoods and local real estate market metrics, practices and contracts, and someone who deeply *gets* the home buying or selling process itself – so they can brief you on it and fruitfully coach you through it.

Have you ever taken a class from a novice teacher vs. a class from an experienced professor? The difference is nuance: a deep, mature understanding of a complex subject allows the more experienced instructor to give you insights into patterns they’ve spotted over time and repeat transactions. Same goes for your real estate pro: you want to make sure that either your agent or someone that will be working with them on your transaction (like their manager or broker) has deep knowledge and understanding in most or all of these areas, so they can share the nuanced insights and patterns they have spotted in the past which you can harness to your advantage in the present.

- Calm resilience. When you lose out on a home to other offers, it can feel like the end of the world. When you list your home, stage it to the nines, and not a single offer is forthcoming, feelings of discouragement, frustration and even depression can easily arise. In both cases, it’s easy to delve into fear (fear that you’ll never get the home you need, or will never be able to move on to the next stage of your life) or paralysis (freezing up because you just don’t know what to do – period).

A great agent – and there are thousands and thousands out there – can bring a massive, game-changing dose of calm resilience to the table. They’ve been through this before. They know that there are lots of homes and lots of buyers out there, so losing out on any one is not a death knell to your dreams. They also know how to tell the difference between a normal delay in receiving an offer or an acceptance on your market and when your approach requires some serious course correction (see #4, below).

A great agent will be able to receive the news that you’ve lost out on a home or take in negative feedback from a prospective buyer, call you and deliver it calmly and right along with some smart, constructive suggestions for action items you should work on next, to keep the process moving forward.

- Frankness and optimism. You want – no – you need your agent to be frankly honest. You need them to be frankly honest with themselves and with you about all facets of the reality you’ll face as you proceed through your transaction. Sellers, you cannot afford to have an agent who will let you persist in fantasy-land beliefs about what your home is worth – contrary to all evidence as to what homes in your area are actually selling for and feedback (read: silence) from prospective buyers who have seen your home – without challenging you to look at the data and adjust your pricing strategy. Buyers, by the same token, you can’t afford to work with an agent who encourages or allows you to make 5, 10, or 15 lowball offers on a home without urging you to face the truth that you need to house hunt at lower price points or make higher offers in order to be successful.

You need an agent who is willing to tell you the truth and have these sorts of hard conversations with you even when you won’t like it.

That said, you want an agent who possesses both this frank integrity and an ultimate optimism that, with right thinking and strategic action, you can and will ultimately succeed at making a great buy or sale.

- Bandwidth. This one might sound strange, but the fact is that it can be difficult to get the advantages of having the best agent in the world if the agent is wildly over-subscribed and so busy they struggle to respond to calls and emails. This is why I don’t always say a great agent will necessarily have years and years of expertise. Some agents who have wonderful experience and wisdom are simply too busy to do the time-intensive guidance your situation may require. And some agents who are new to real estate bring highly relevant expertise and skills they’ve developed in other careers, have ample time to devote to your transaction and can enlist the real estate-specific insights of an experienced team leader, manager or broker.

If you know you’re going to want to meet up weekly for a house hunting session or debrief with your agent, tell them this up front and ask them flat-out how much time they can devote to your process. Make sure you’re comfortable with their response or solution (example – their listing specialist or partner can meet with you when they can’t) before you make your pick.

My advice for agent-finding is to engage in a multi-step process:

- First, make sure you get referrals from your friends, colleagues and relatives to the agents they have worked with and love.

- Then, check all of your prospective agent candidates out online. Narrow them down a bit by what you see in terms of reviews and style of advice you see them providing on channels like their blog, website or social media pages.

- Reach out to all the people on your short list through whatever medium you prefer to communicate – phone, email, etc. – and note how quickly you get responses.

- Then book appointments to meet with a handful of agents and let them present their method to you.

- Get references and check in with those past clients – ask them to tell you about their transaction experience, warts and all.

By the end of this process, you’ll likely find someone who fits just-right with your own personality, timing and transactional needs and possess these five traits.”

Are You Ready – Really Ready – To Buy That Home Of Your Dreams?

A conversation I have had multiple times in the past few weeks has centered around my buyers' “readiness” to make an offer on a home. Many of these buyers have been disappointed to learn that they are not – yet – in a position to make an offer on the house that has them so excited. That is not only a disappointing conversation for them, it is a difficult conversation for me because I never like discouraging anyone. Today I choose to view this as an opportunity to better prepare them for what is likely to be one of the biggest financial as well as emotional life decisions they will make, at least in the near future.

So what’s going on? Many people are still unaware that buying a home is a team effort, and an integral part of that team is a well-qualified mortgage lender. What do I mean by this? Buyers need to be aware that a large number of purchase-and-sale transactions never close. Transactions often fail during the inspection phase, but many often fail because something goes wrong during financing. As your Realtor, when you come to me ready to buy, I need you to be pre-approved by a mortgage lender so that we can put our best foot, and best offer, forward on that home of your dreams. I need a written pre-approval letter from your lender for the offer you are making. And then we need to all work together throughout the transaction to make sure the details and timing of your contract stay on track so your purchase closes on time and as smoothly as possible.

What can go wrong? First is failing to be pre-approved when you find the home that excites you. The pre-approval process doesn’t necessarily take long, but in this market even a day or two can mean the difference between getting an offer in or losing out to someone better prepared. You need to know in advance what documents you will need to provide when actually applying for a loan, you need to know how much you can afford to spend on a home, and you need to know how those mortgage payments fit into your financial planning for your future. That takes sitting down with a good lender in advance of house shopping, and you should expect the process to take a few days.

Second, choosing the wrong lender can negatively impact your chances. Really? Yes, absolutely! The mortgage lending business is extremely competitive, and not all lenders are created equal. Not all have the same education, training, experience, or ability to serve their clients. First and foremost, mortgage lending is a sales position, and the goal of the various lending institutions is to get you, the customer, to buy what they are selling. It doesn’t matter what name is behind the individual or what interest rate they promise if they can’t or don’t get your loan closed on time. Their failure to perform can cost you YOUR house – yes, really – not to mention a great deal of grief and heartache. And when presenting that pre-approval letter to a seller, if your lender's name rings alarm bells, that can be the difference between having your offer accepted or having it rejected.

So how do you find the “right” lender? First, find your comfort zone. Decide whether or not you are comfortable going through the process electronically (many lenders are set up so you can apply, submit documents, get approved, and obtain a loan, all online) or whether you prefer to sit down, face-to-face, with someone.

Second, ask for referrals! Don’t assume the place you currently bank, the online lender that offers great deals, or the name you hear on the radio with discounted rates or rebates is the best place to start. (Rates do play a role in your decision, but the bottom line should be who can best get this accomplished for you.) Do you have a Realtor? Ask them for a couple of referrals. Believe me – we are VERY invested in getting your transaction closed for you, and we will do our best to refer you to someone who will work with us as well as with you to make your dreams come true! Ask your attorney, or your CPA. Do you have friends or family who have recently completed a purchase? Ask them. See if any names come up more than once. And remember – you are looking for the name of an individual within a company, not the name of the company itself. Your service will only be as good as the individual involved.

Finally, interview your prospective lender. Sit down with them in person or talk to them on the phone. Make sure they are available to you. Ask about their processes. Ask about their timelines. Ask about their successes and their failures. Ask about APR’s and Truth in Lending and Loan Estimates and anything and everything else you can think of. They should talk to you about all of that as well as discuss your credit with you, your financial goals, and how your loan will fit with your hopes and dreams for your future. Make sure you are comfortable with the individual you choose as well as with the company behind them. At the end of the day, your mortgage loan will be originated, processed, approved, and closed by the people you choose to work with. Companies and their systems will be behind those people, backing them up, but it is the individuals who will make it happen. Ultimately you want to look for someone who will focus on you, and not just on your loan.

As always, if you have any questions, please feel free to ask. I’m here to help!

One More Time, Real Estate is a Great Investment

The information I am sharing below is not mine – I am quoting others. Why? Because the discussion and the points raised are brief, salient, and worth considering. Debates are swirling all around us, and the topic of the financial value of home ownership can certainly be debated. As with anything else, the results are dependent upon many factors, including the homeowner's goals, timeframe, and consideration put into the investment. Where do you fall in this debate? Most of us still believe homeownership is integral to achieving the American dream!

In a recent blog post on Marginal Revolution, economist Alex Tabarrok discussed homeownership as an investment.

Here is what Mr. Tabarrok had to say:

“Housing is overrated as a financial investment. First, it’s not good to have a significant share of your wealth locked into a single asset. Diversification is better and it’s easier to diversify with stocks. Second, unless you are renting the basement, houses don’t pay dividends. Stocks do. You can hope that your house will accumulate in value but don’t count on it. Indeed, you should expect that as an investment your house will appreciate less than does the stock market. You didn’t expect to get a great investment and a place to live in the meantime, did you?”

Here is a rebuttal:

It has been reported many times that the American Dream of homeownership is alive and well. In earlier blog posts, I have touched on the personal benefits to homeownership. Below is additional discussion of the financial benefits.

Eric Belsky, the Managing Director of the Joint Center of Housing Studies at Harvard University expanded on the top financial benefits of homeownership in his paper –The Dream Lives On: the Future of Homeownership in America.

Let’s use some quotes from Belsky’s study to address comments by Mr. Tabarrok:

Tabarrok:

“Housing is overrated as a financial investment.”

Belsky:

“Since many people have trouble saving and have to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings to another day.”

Tabarrok:

“You can hope that your house will accumulate in value but don’t count on it. Indeed, you should expect that as an investment your house will appreciate less than does the stock market.”

Belsky:

“Homeownership allows households to amplify any appreciation on the value of their homes by a leverage factor. Even a hefty 20 percent down payment results in a leverage factor of five so that every percentage point rise in the value of the home is a 5 percent return on their equity. With many buyers putting 10 percent or less down, their leverage factor is 10 or more.”

Tabarrok:

“You didn’t expect to get a great investment and a place to live in the meantime, did you?”

Belsky:

“Homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord.

Homeowners are able to deduct mortgage interest and property taxes from income…On top of all this, capital gains up to $250,000 are excluded from income for single filers and up to $500,000 for married couples if they sell their homes for a gain.”

Bottom Line

Homeownership has and continues to make sense for many Americans for an assortment of social and family reasons. When your purchase is made thoughtfully, it can also make sense financially. If you are considering a purchase this year, contact a local real estate professional who can help evaluate your ability to do so. And, as always, if you have questions, I am happy to help!

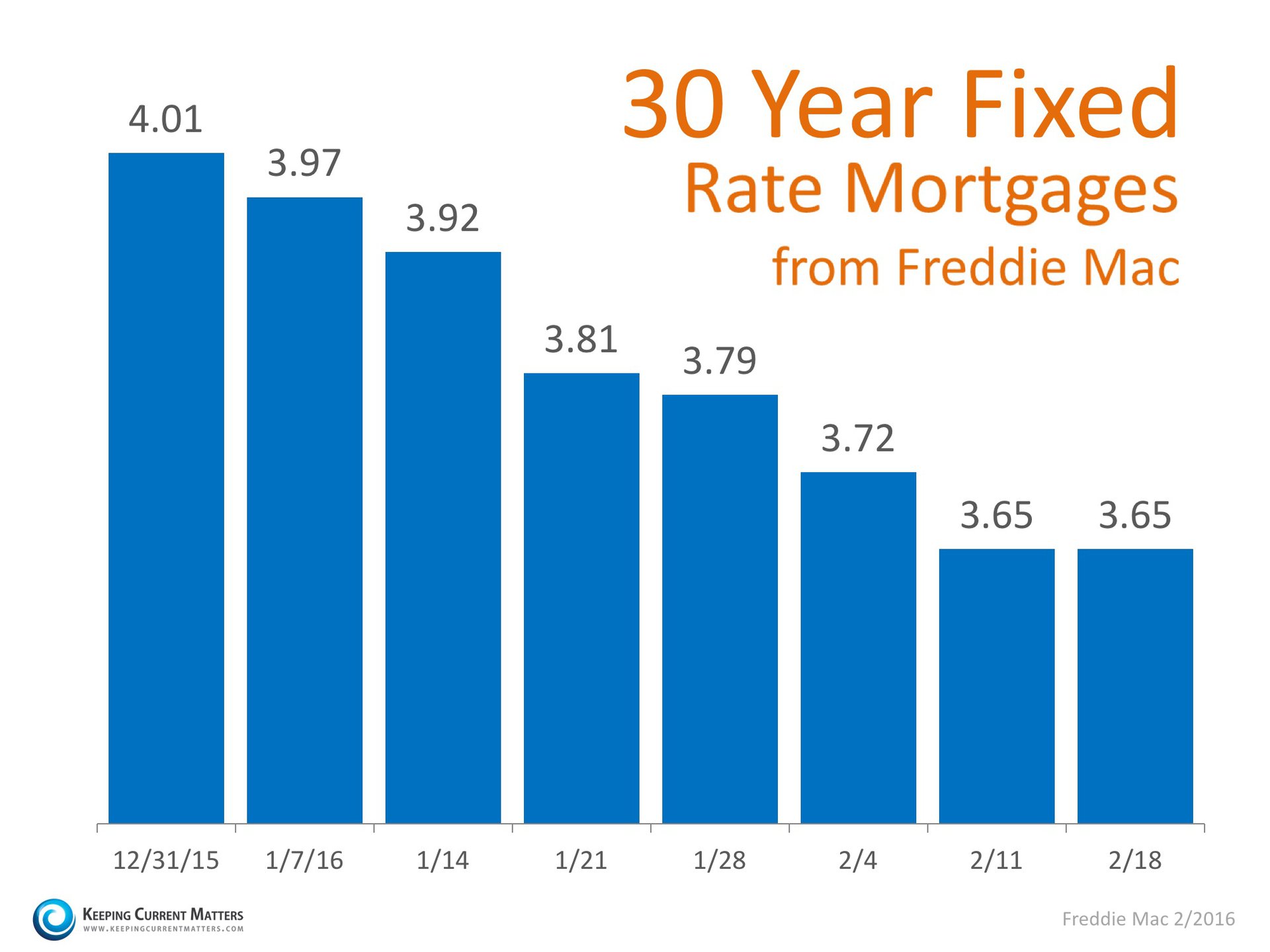

Mortgage Rates Again at Historic Lows

Just a few weeks ago, I shared an article discussing where mortgage interest rates may be heading over the next twelve months. In it were quoted projections from Fannie Mae,Freddie Mac, the Mortgage Bankers’ Association and the National Association of Realtors. Each predicted that rates would begin to rise slowly and steadily throughout 2016.

However, shaky economic news and a volatile stock market have actually caused rates to drop six out of the last seven weeks, and mortgage interest rates have remained at 3.65% for the past two weeks.

Rates have again fallen to historic lows, yet many experts still expect them to increase in 2016. Time will tell what rates, and the housing market, will do. The only thing we know for sure is that, according to Freddie Mac, current rates are the best they have been since last April. Do you have a relationshp with a trusted lender or real estate professional? If so, now might be the time to discuss how you can benefit from today's once-again historically low rates.

Bottom Line

If you are thinking of buying your first home or moving up to your ultimate dream home, now is a great time to get a sensational rate on your mortgage. And, a always, if I can answer any questions or help in any way, please feel free to ask. I'm here to help!

Homes Are Selling Quickly Across The Country

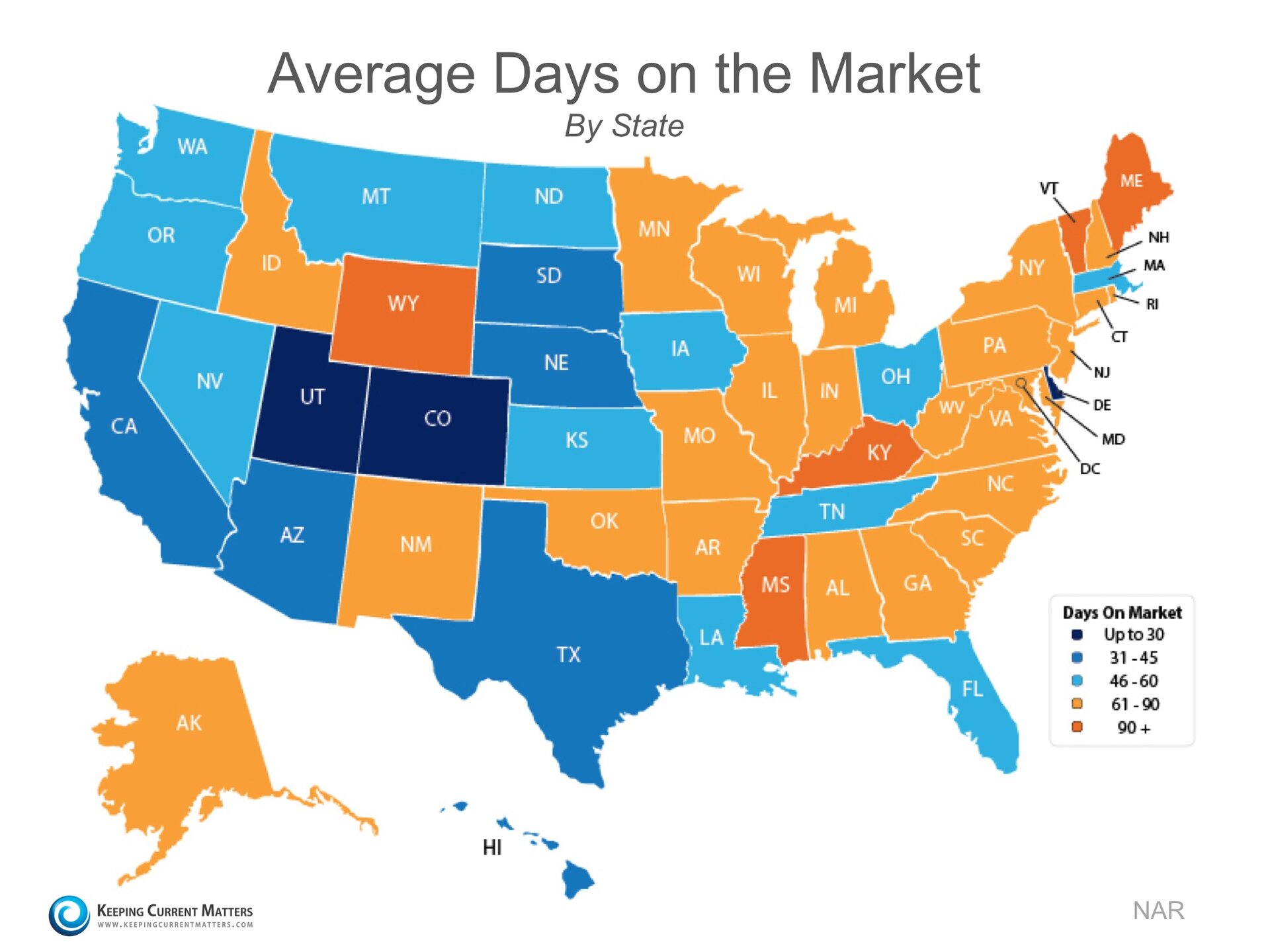

According to the National Association of Realtors’ (NAR) Existing Home Sales Report, homes were on market for an average of 58 days in December. This was slightly longer than the 54 days in November, but still better than the 66 days experienced in December 2014. What is the significance of those numbers? If you're buying or selling a home, no doubt you've actually felt it. Those numbers mean we are in a seller's market, with values continuing to go up while inventory remains scarce. Here is a surprising statistic:

32% of homes across the country were on the market for less than a month!

Colorado, Utah and Delaware led all states as homes are selling in 30 days or less on average. The map below was created using results from NAR’s Monthly Realtor Confidence Survey. The map below indicates homes in Washington State are selling in 46-60 days on average, but that's average. In hot markets around Puget Sound, many homes are active for only a few days before multiple offers send them pending. It's a frustrating time for buyers when there are so few choices and competition is so strong! However, securing the home of your dreams isn't impossible.

Bottom Line

Buyer demand remains strong, and if you are hoping to purchase a new home you may find yourself with stiff competition. The inventory of homes for sale remains low, and when and how those numbers will change remains uncertain. If you are considering selling your home, that means "now" may be exactly the right time to do so. If you are contemplating a purchase, having an experienced guide through the process is more important today than ever. Whether you are considering buying or selling, meeting with an experiencedl real estate professional who can discuss your options and help you navigate all the possibilities is crucial to your success. And, as always, if I can answer any questions or be of assistance, please don't hesitate to let me know. I'm here to help!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link