The recent talk of Greece and its financial challenges has some questioning whether the U.S. could also return to the crisis we experienced in 2008. Some are looking at the rise in real estate values and wondering whether we are in the middle of another housing price bubble. This is a valid question, and one deserving of real consideration.

What actually is a price bubble?

Jack M. Guttentag, Professor of Finance Emeritus at the Wharton School of the University of Pennsylvania, in a recent article explained:

The question is being asked with increasing frequency, and also with great anxiety. The last housing bubble led to a financial crisis followed by a recession.

Many of those commenting on the question, however, don't understand what a price bubble is. It is NOT a marked rise in prices. Sharp price increases are common, and pose no threat to the stability of the economy whereas price bubbles are rare and do pose a threat.

A price bubble is a rise in price based on the expectation that the price will rise. Sooner or later something happens to erode confidence in continued price increases, at which point the bubble bursts and prices drop. What makes it a price bubble is that the cause of the price increase is an expectation that the price will increase, which sooner or later must reverse itself.”

What are home prices doing?

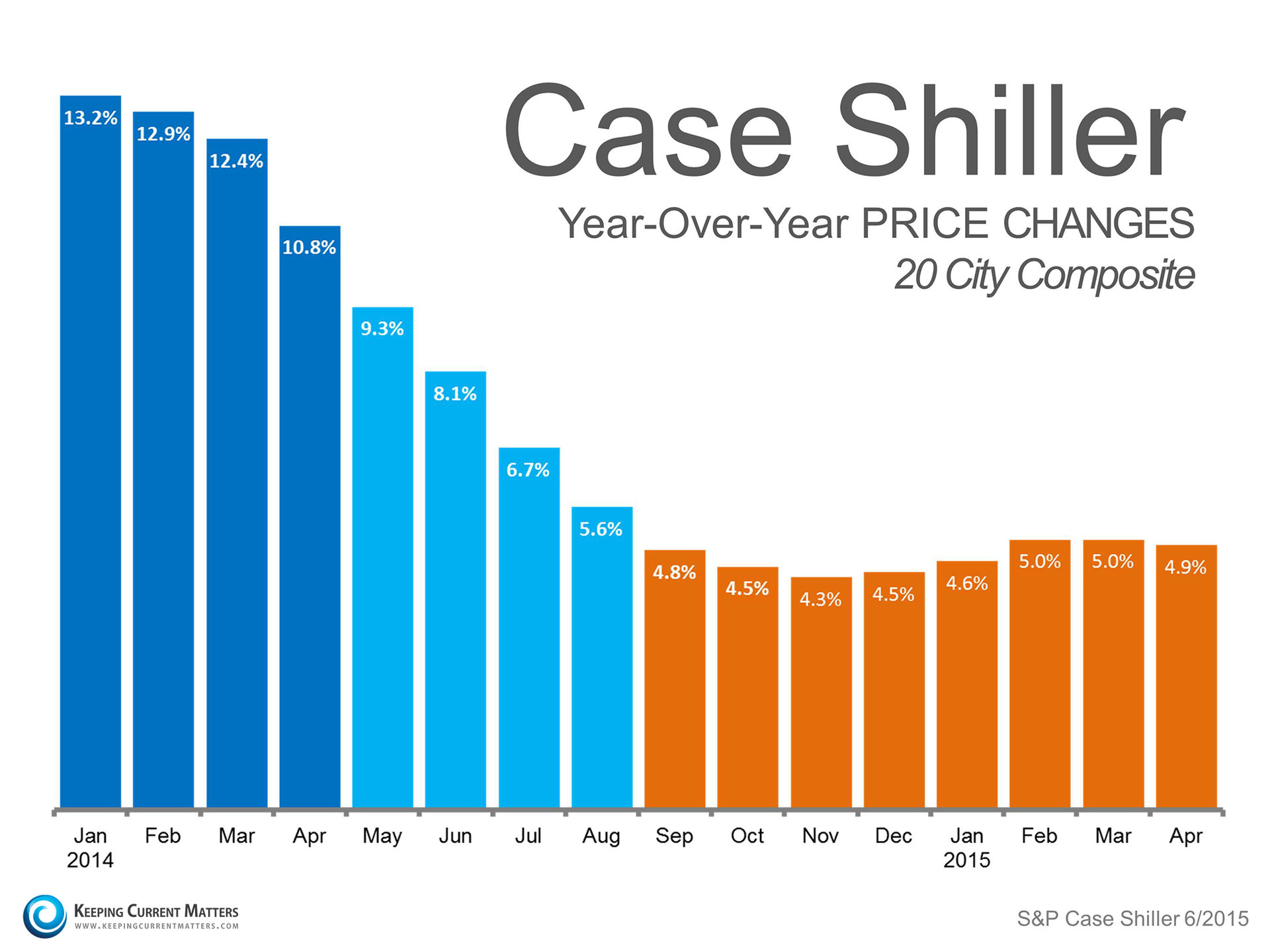

Though home values are continuing to appreciate, the acceleration of the increases has slowed to relatively stable, year-over-year numbers which reflect a healthy housing market. Here is a chart showing year-over-year appreciation since January of last year:

We can see that appreciation rates have dropped from double digit numbers in January of 2014 to more normal rates of 5% or lower. These numbers are more consistent with historical price increases more closely tied to the rate of inflation.

Bottom Line

Are we looking at another housing price bubble this year? I think Nick Timiraos of the Wall Street Journal put it best in a recent tweet:

“Predictions of a new national home price bubble look unfounded for now, according to data.”

Would you like more information specific to your area? As always, please feel free to ask any questions you might have. I'm more than happy to help!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link