Several of my recent posts have focused on building wealth through homeownership. As you age, equity in your home can be translated into options – options as to where and how you will choose to live through the changes life brings after retirement. Within the next five years, Baby Boomers are projected to account for more household growth than any other generation during that same time period, according to the Joint Center for Housing Studies of Harvard. In a recent Merrill Lynch study, “Home in Retirement: More Freedom, New Choices” they surveyed nearly 6,000 adults ages 21 and older about housing. The following are some of the reasons they uncovered for the expansive growth in Baby Boomer households.

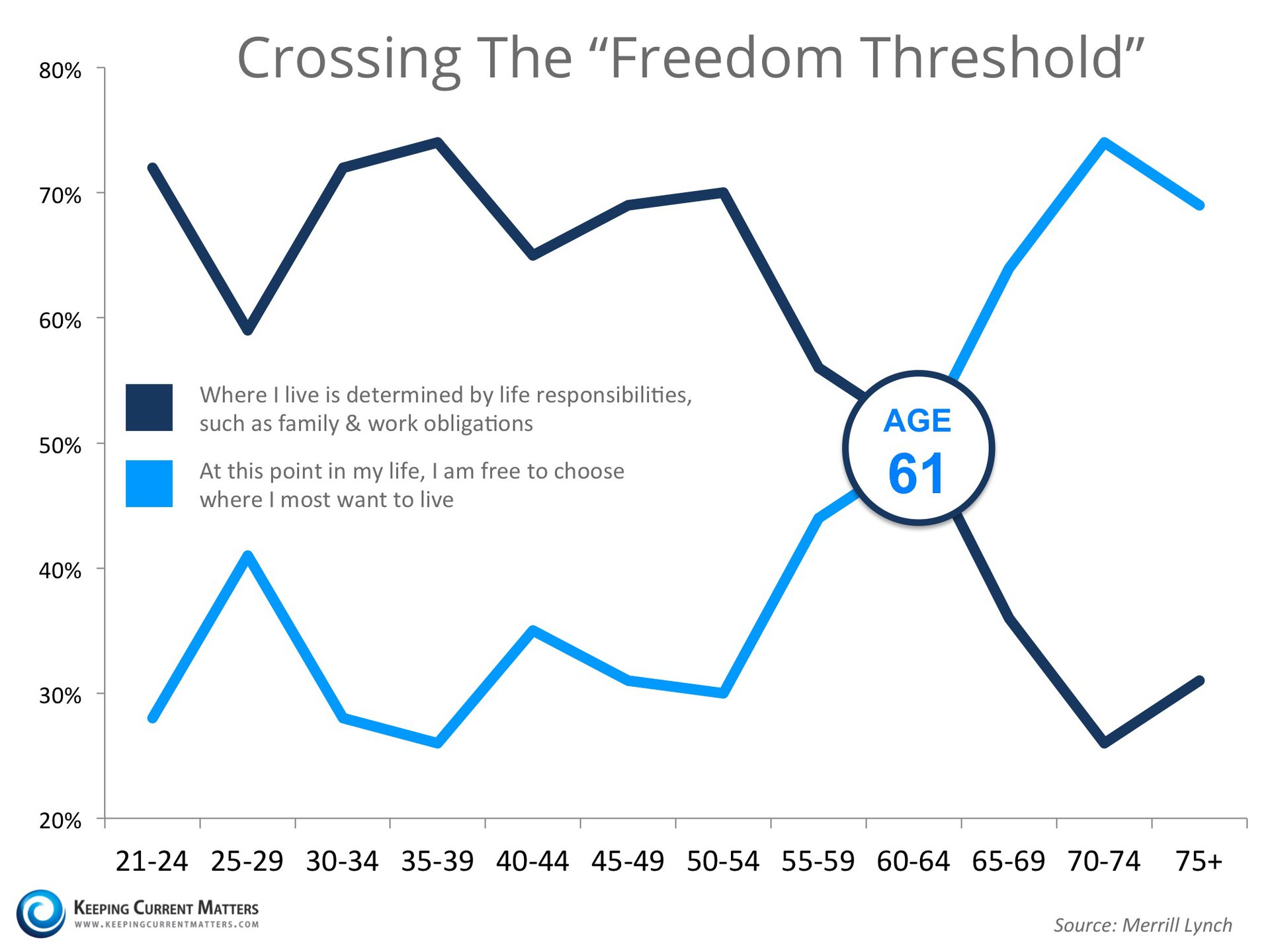

Crossing the “Freedom Threshold”

Throughout our lives, there are often responsibilities that dictate where – and how – we live. Whether being committed to the best school district for our children, being close to our jobs, or being constrained by some other factor that is preventing a move, the study found that there is a substantial shift that takes place at age 61.

The study refers to this change as “Crossing the Freedom Threshold”, when where you live is no longer determined by responsibilities but rather by the freedom to live wherever you like. (see the chart below)

As one participant in the study stated:

“In retirement, you have the chance to live anywhere you want. Or you can just stay where you are. There hasn’t been another time in life when we’ve had that kind of freedom.”

On the Move

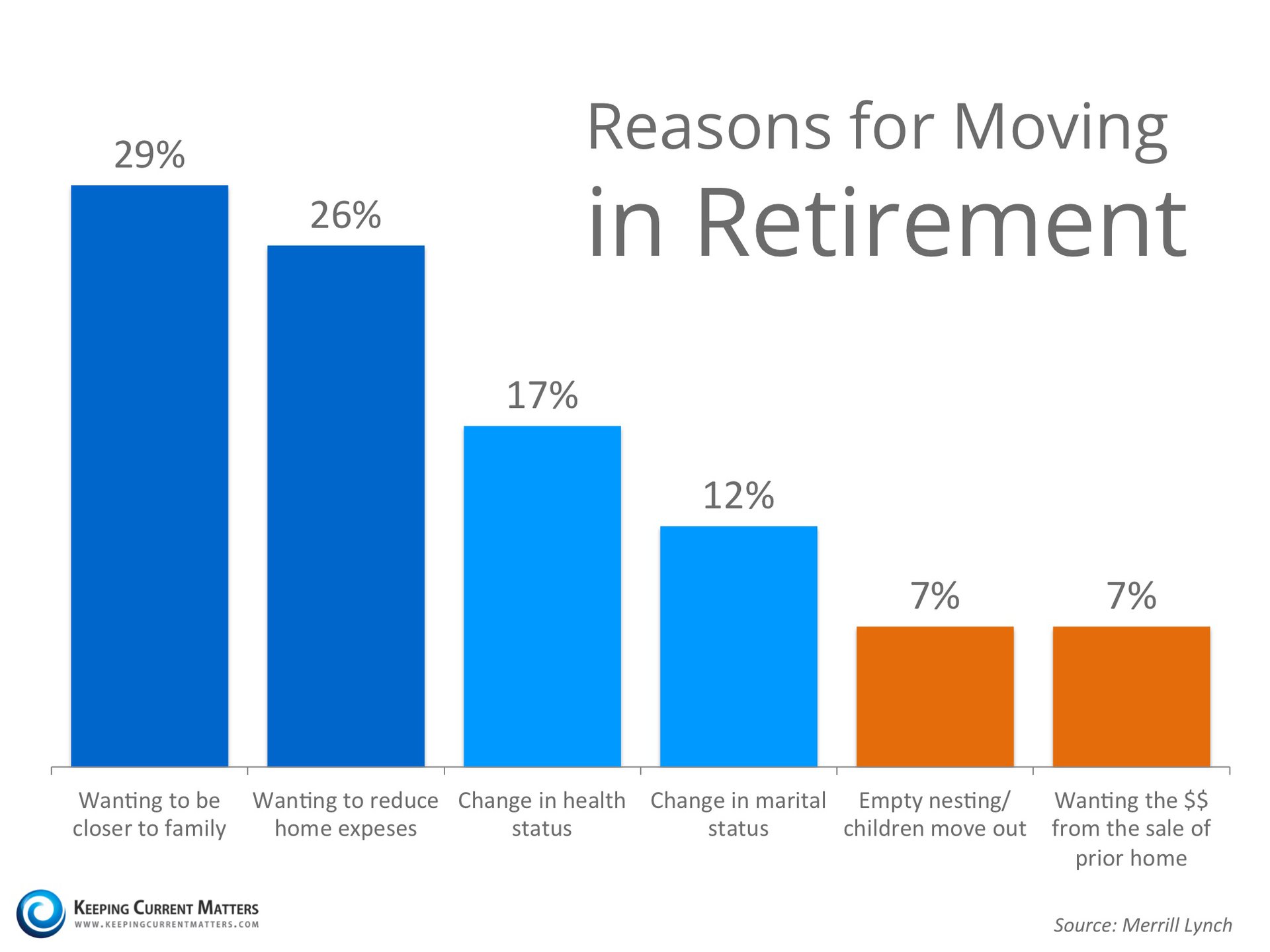

According to the study, “an estimated 4.2 million retirees moved into a new home last year alone.” Two-thirds of retirees say that they are likely to move at least once during retirement, and many know and plan to move more than once.

The top reason to relocate cited was “wanting to be closer to family” (29%), a close second was “wanting to reduce home expenses”(26%). Some moves are a result of cashing out the equity in a current home in order to pursue a different lifestyle unconstrained by mortgage payments. See the chart below for the top 6 reasons broken down by category.

Not Every Baby Boomer Downsizes

There is a common misconception that as retirees find themselves with fewer children at home, they will instantly desire a smaller home to maintain. While that may be the case for half of those surveyed, the study found that three in ten decide to actually upsize to a larger home.

Some retirees are choosing to buy a home in a desirable destination with extra space for large family vacations, reunions, extended visits, or to allow other family members to move in with them. More and more families are pooling funds and looking for homes with mother-in-law accommodations or Accessory Dwelling Units where multi-generational families can live together while allowing aging in place.

"Retirees often find their homes become places for family to come together and reconnect, particularly during holidays or summer vacations."

Bottom Line

If your housing needs have changed or are about to change, meet with a local real estate professional in your area who can help with deciding your next step. Spend time exploring the options homeownership has offered you in the past and the new choices you have in front of you. And, as always, if I can be of service in some way, please don't hesitate to let me know!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link