The National Association of Realtors (NAR) recently released their July edition of the Housing Affordability Index. The Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data. This information is based upon national figures but is adjustable to our area by modifying the median sales price for the neighborhood in which you are interested.

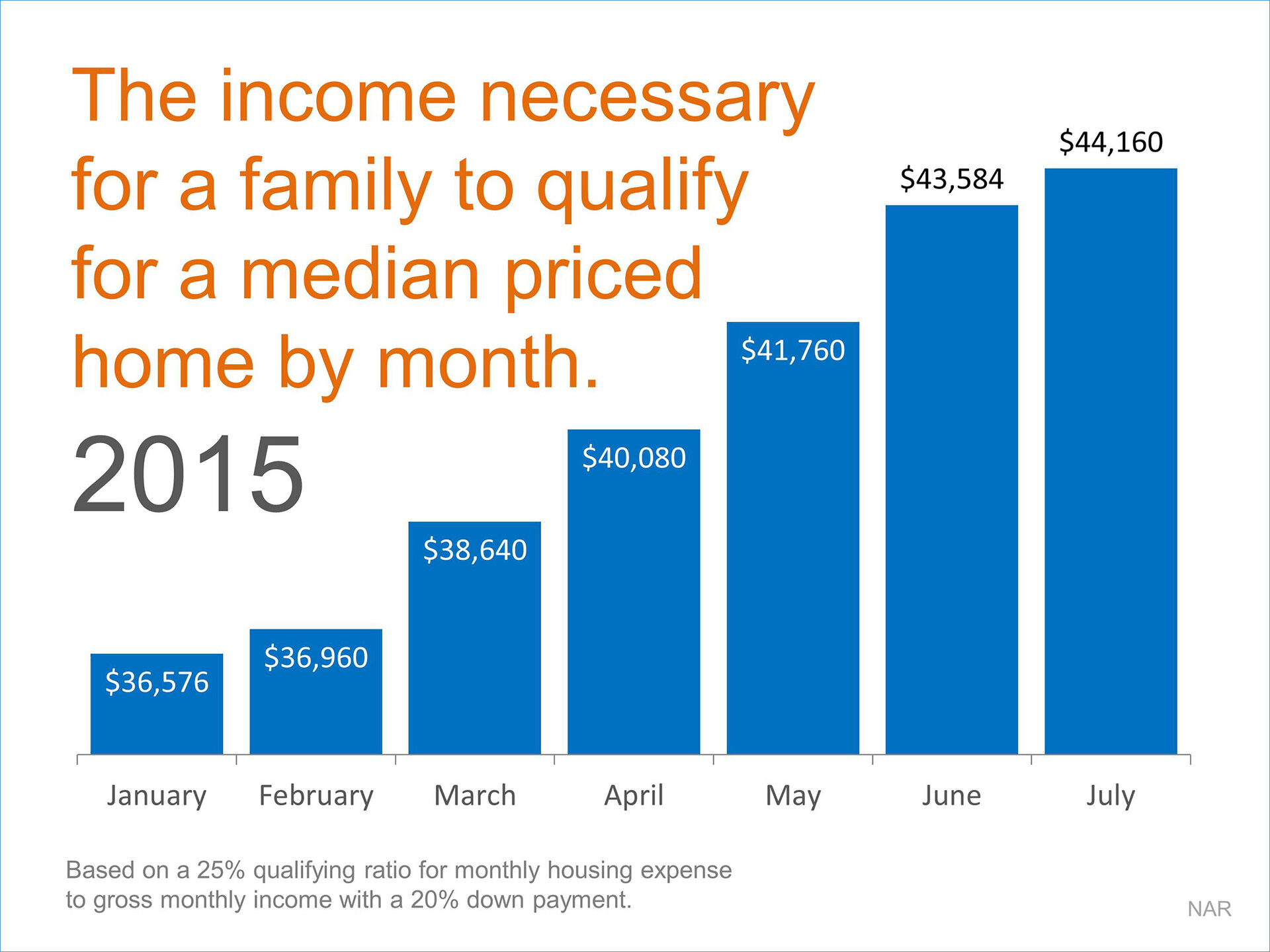

NAR looks at the monthly mortgage payment (principal & interest) which is determined by the median sales price and mortgage interest rate at the time. With that information, NAR calculates the income necessary for a family to qualify for that mortgage amount (based on a 25% qualifying ratio for monthly housing expense to gross monthly income and a 20% down payment).

Shown below is a graph of the income needed to buy a median priced home in the country over the last few years. From 2012 to 2015, your income would have had to increase by over 38% to qualify for a home purchase at median prices. And the income requirement has accelerated even more dramatically this year as prices have steadily risen.

Bottom Line

Interest rates continue to remain low. However, some buyers may be waiting to save up a larger down payment. Others may be waiting for a promotion and more money. Understand that, while you are waiting, the requirements are also changing and spending time may cost you more money than you realize. And, as always, if I can answer any questions for you or provide you with more information, I am here to help!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link