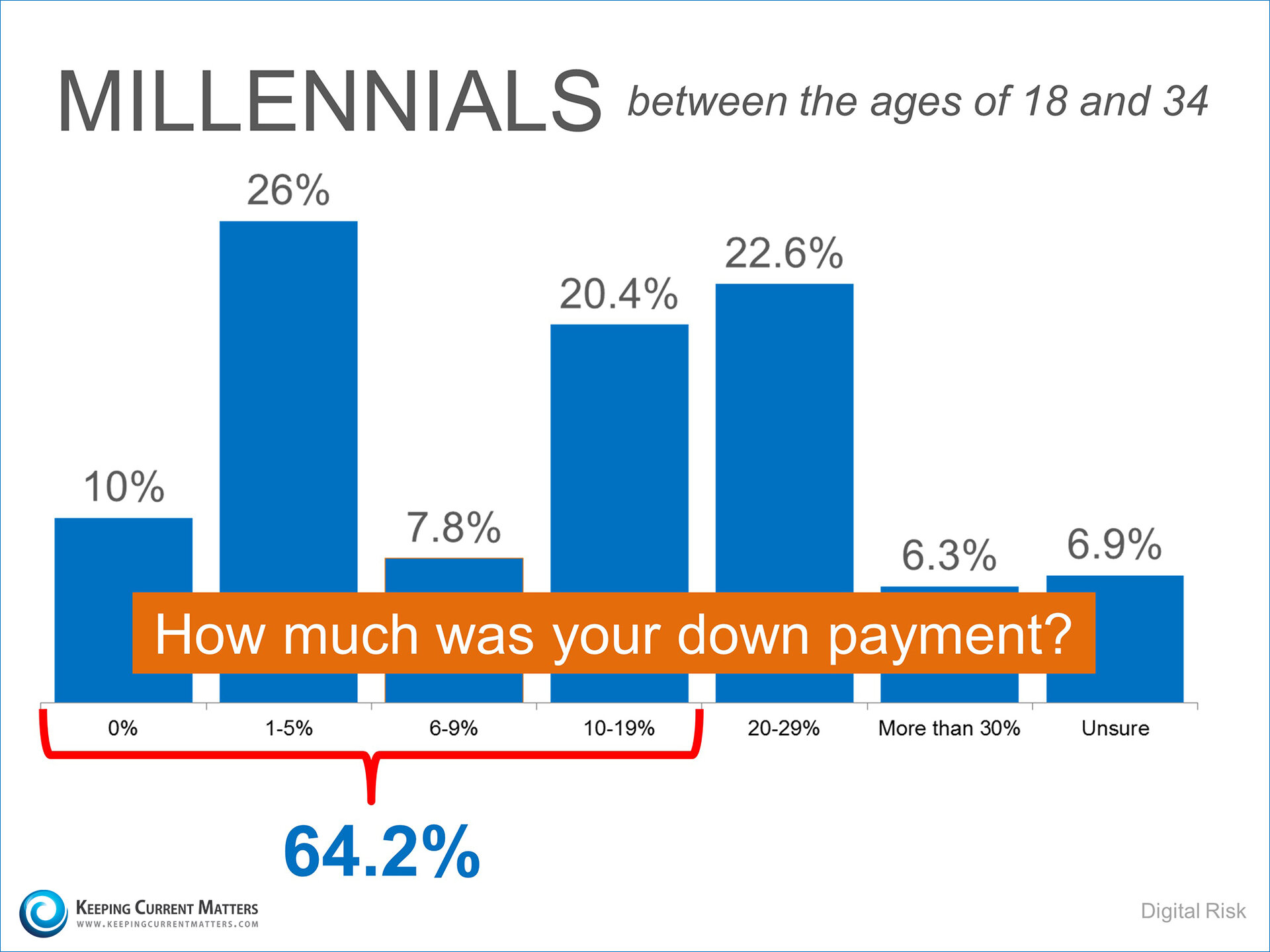

Digital Risk recently polled Millennials about the housing market. Among their findings was the fact that nearly two-thirds of that generation who have recently purchased a home have done so with less than 20% down, with 36% putting down less than 5%.

Here is a graph detailing the results:

This means that more and more Americans between the ages of 18 and 34 have stopped paying their landlord’s mortgage and have started building their own family’s wealth. Homeownership is definitely one way for families to build for the future!

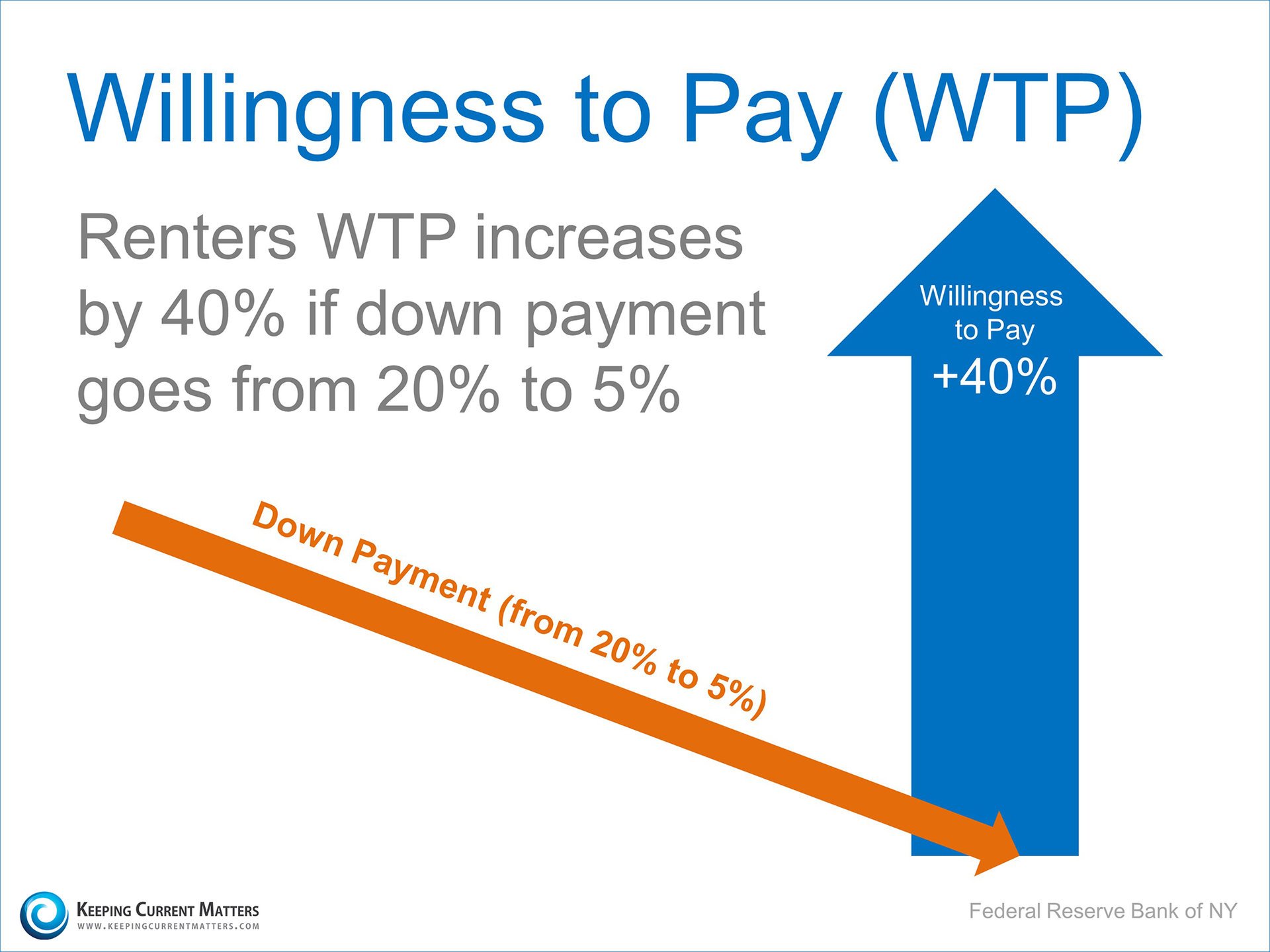

Millennials aren’t the only ones taking advantage of lower down payments.

The Federal Reserve Bank of New York found that if the down payment required to purchase a home went from 20% to 5%, a renter’s Willingness To Pay (WTP) increased by 40%. That's a significant shift in thinking, and one that can have a major impact on the housing market.

One problem is that thirty-six percent of Americans still believe a 20% down payment is always required when buying a home. Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs available that allow less cash out of pocket. FHA, USDA, and VA loans may be options for those wanting to take the step up to home ownership but who may be unable to come up with the 20% down called for by a conventional mortgage. A reputable mortgage professional should be able to help you gather more information on options suitable to your situation.

Bottom Line

If you are one of the many renters now realizing that the home of your dreams is obtainable, contact a local real estate professional who can help you get started. Working with a great team of professionals can help make those dreams come true. And, as always, if I can anwer questions or be of help, please don't hesitate to let me know!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link