The inaugural Opportunity Cost Report was released recently by realtor.com. The report explained that “with interest rates and home prices expected to climb in the next year, the financial penalties of delaying or forgoing a home purchase in today's market have become very steep”.

The report estimates that, based on today's dollars, the average purchaser would accumulate $217,726 in increased wealth over a 30-year period.

That is assuming, of course, that prices and rates DO climb. Are they rising? Our office meets every Monday to discuss changes in the real estate and mortgage markets. Just this morning, we were discussing current mortgage rates with a conventional 30-year fixed mortgage rate now at 4-3/8%. The cost of buying down that rate by 1/4% is running about 1% of the loan value, which can be costly. Those rates have moved up from 4% just a few months ago. And prices of homes in all areas have been climbing and are continuing to climb.

What could this mean to someone sitting on the fence waiting to buy?

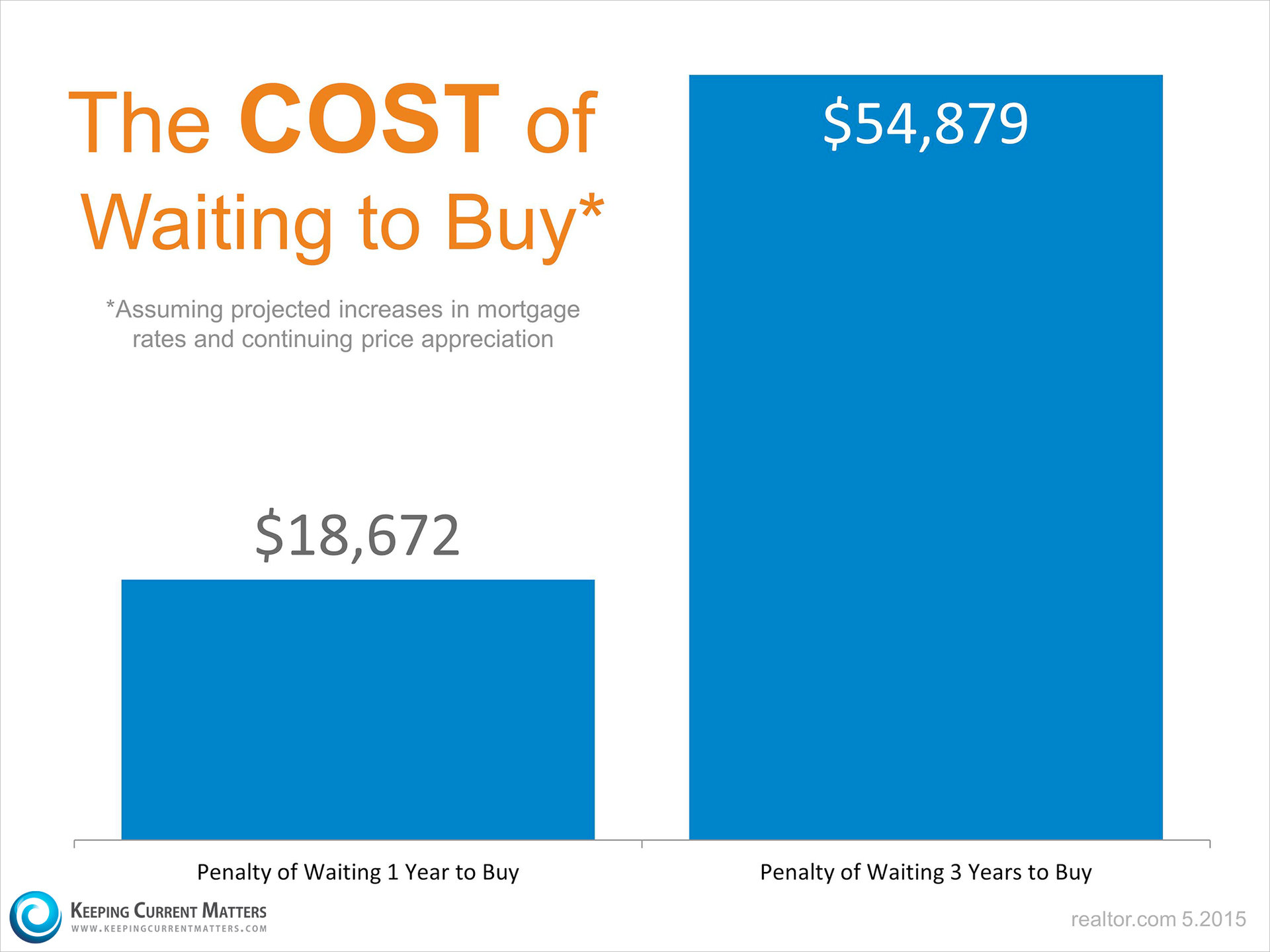

Experts believe that both home prices and mortgage interest rates will increase over the next twelve months. We are seeing that as fact in our County right now. Obviously, if this continues to happen, the monthly cost of a home a year from now will be dramatically higher than it is today. The Opportunity Cost Report breaks down exactly how much a purchaser could lose over increments of one year and three years. Here are the results based on an average purchaser in the U.S. delaying their purchase:

Bottom Line

If you are ready, willing and able to buy a home, waiting doesn't make sense. And waiting could be costly in the long run. Would you like more information? Would you like to know your options? Please feel free to let me know. I'm more than happy to help!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link