Most of us share a belief that there are some social advantages to home ownership. However, some people question the financial benefits of owning a home. When questioning the assumptions, we can take advantage of three recent studies to shed some light on the issue.

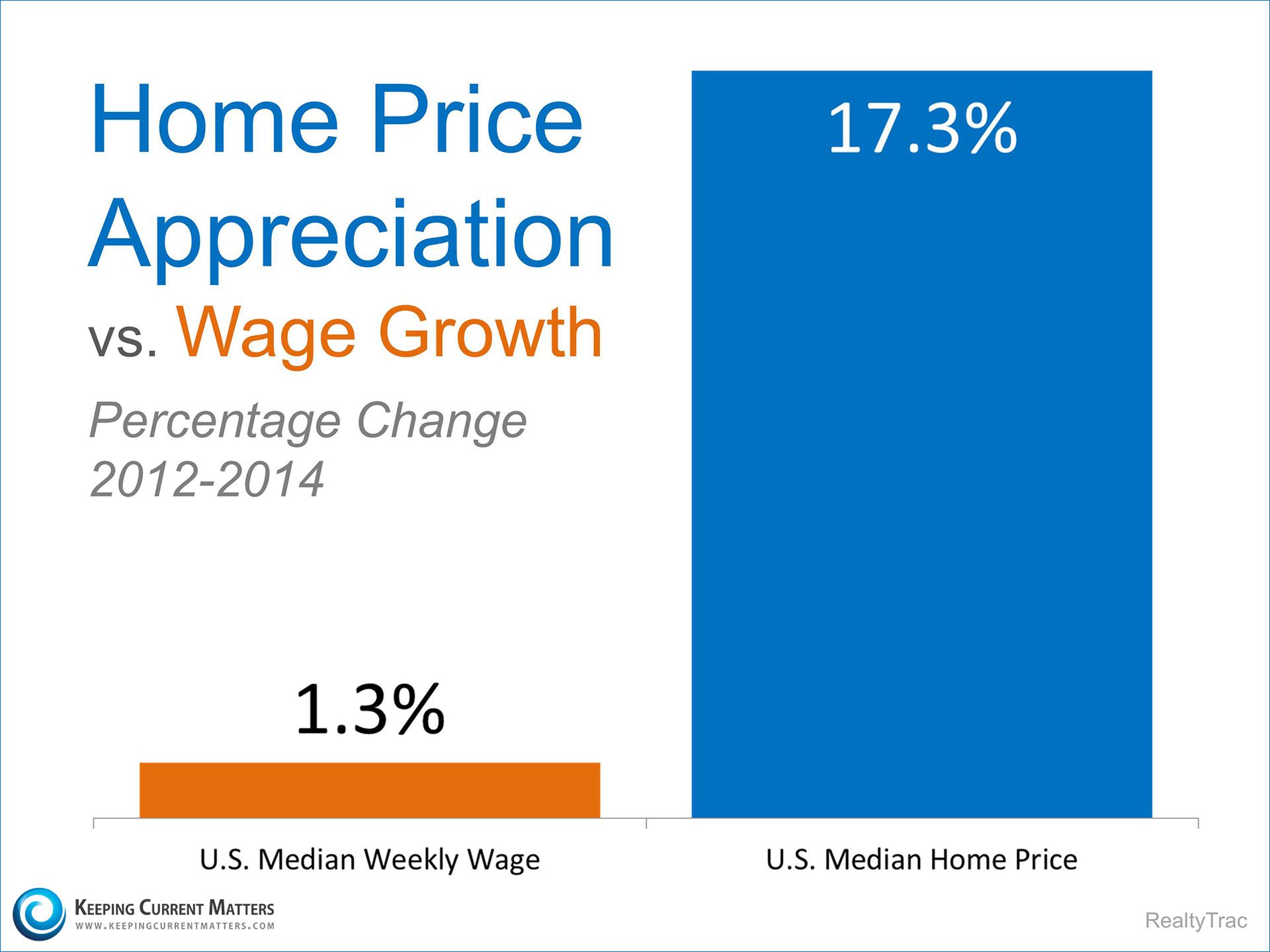

RealtyTrac recently released a report comparing home price appreciation to wage growth over the last two years. The study revealed that home price appreciation has outpaced wage growth in 76% of U.S. housing markets during that same time period. Put simply, that means our buying power is decreasing over time. But by how much? Here is a graph showing their findings:

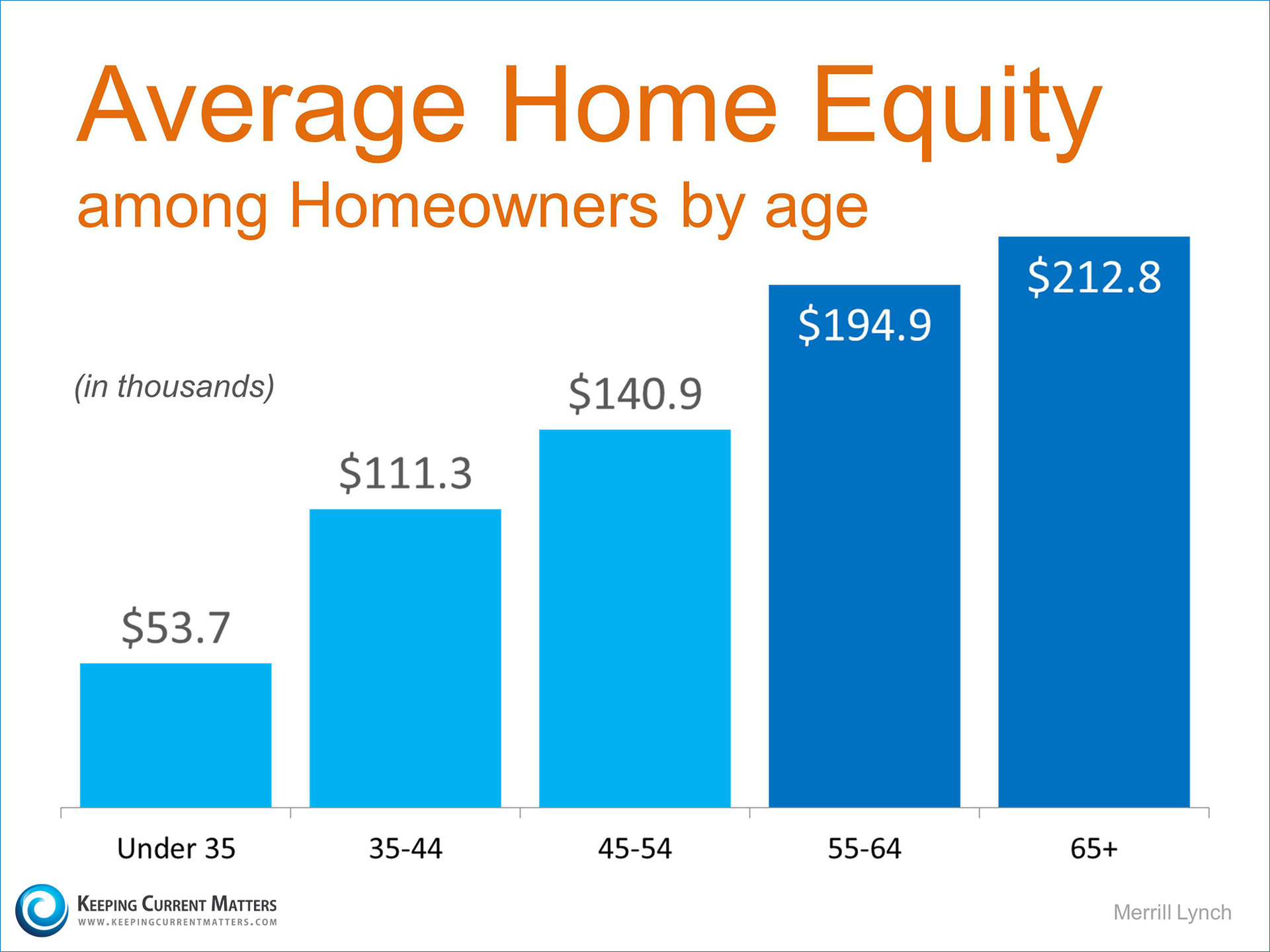

This is a huge gap, a 16% deviation over 24 months in three-quarters of the U.S. housing markets. In a previous blog we discussed the importance of home value appreciation in determining the net wealth of most American families. Merrill Lynch just issued a report covering the issue. Their findings are shown here:

On average, putting the benefits of home value appreciation to work as early in your life as possible makes financial sense in today's market when looking at wealth building.

But, does it make sense to buy now?

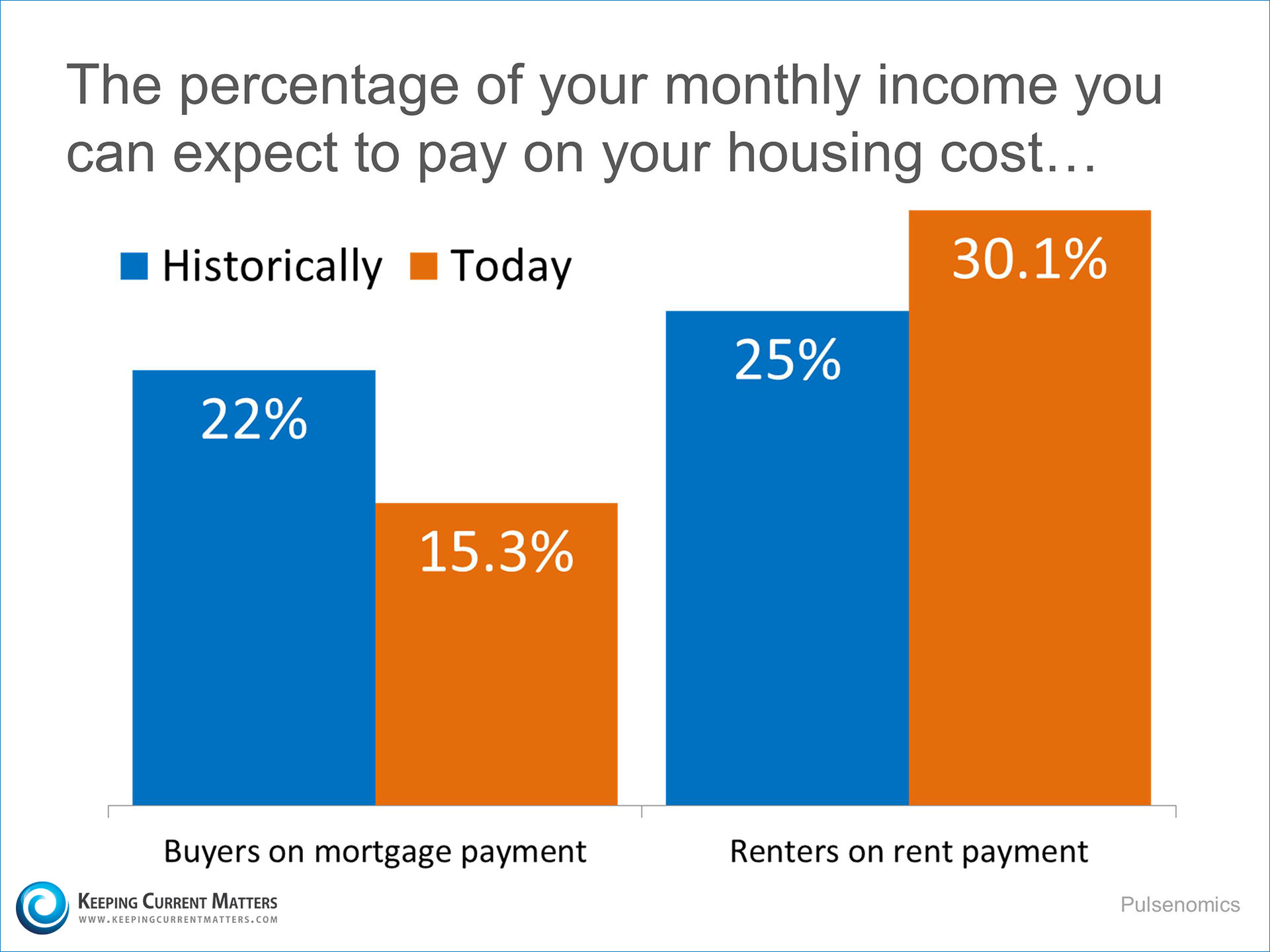

The survey company Pulsenomics just issued their findings on the cost of owning versus the cost of renting. They compared historical averages to the cost you can expect to pay today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link