Today, Freddie Mac is scheduled to start buying mortgages with down payments of only three percent – the first time down payments have been this low on Freddie Mac loans in nearly five years. The program is called Freddie Mac Home Possible AdvantageSM.

What is the Impact?

In a recent copy of the publication "Executive Perspectives," Dave Lowman EVP, Single-Family Business Freddie Mac, explained the potential impact this program will have on the housing market:

“There's a new reason Realtors and lenders may expect more qualified borrowers at the closing table during this spring's home buying season. In addition to low mortgage rates and rising job growth, the down payment hurdle is starting to shrink for creditworthy borrowers, including first-time homebuyers.”

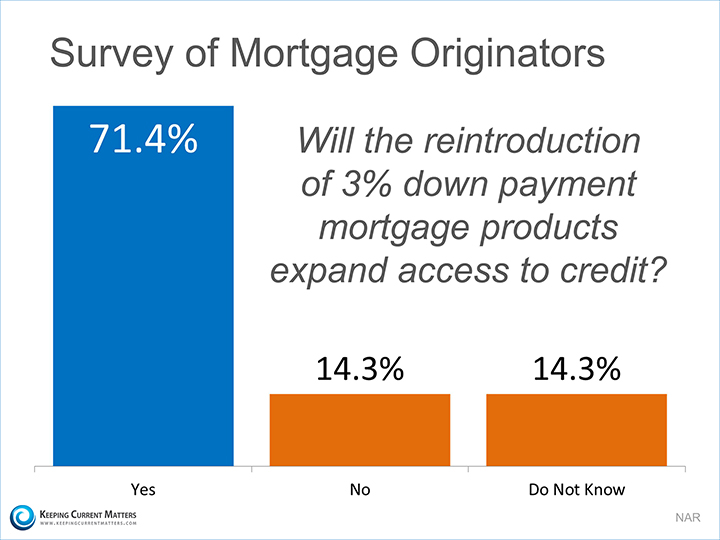

And the mortgage industry appears to agree with Mr. Lowman. In a recent survey of mortgage originators by the National Association of Realtors (NAR), it was revealed that the majority of loan officers believe the move to a lower down payment will increase access to mortgage credit for many would-be homeowners. The chart below illustrates that survey’s findings:

And What is the Bottom Line?

Many potential buyers are “ready and willing” to buy a home but have been afraid they may not be “able” because of a lack of adequate savings for a down payment. Given this new move on the part of Freddie Mac, that hurdle may be just that much easier to overcome. Do you have questions? Feel free to ask, and I will be more than happy to help you understand what the new rules may mean to you!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link