The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be. That is why it is important to know where rates are headed when deciding to start your home search.

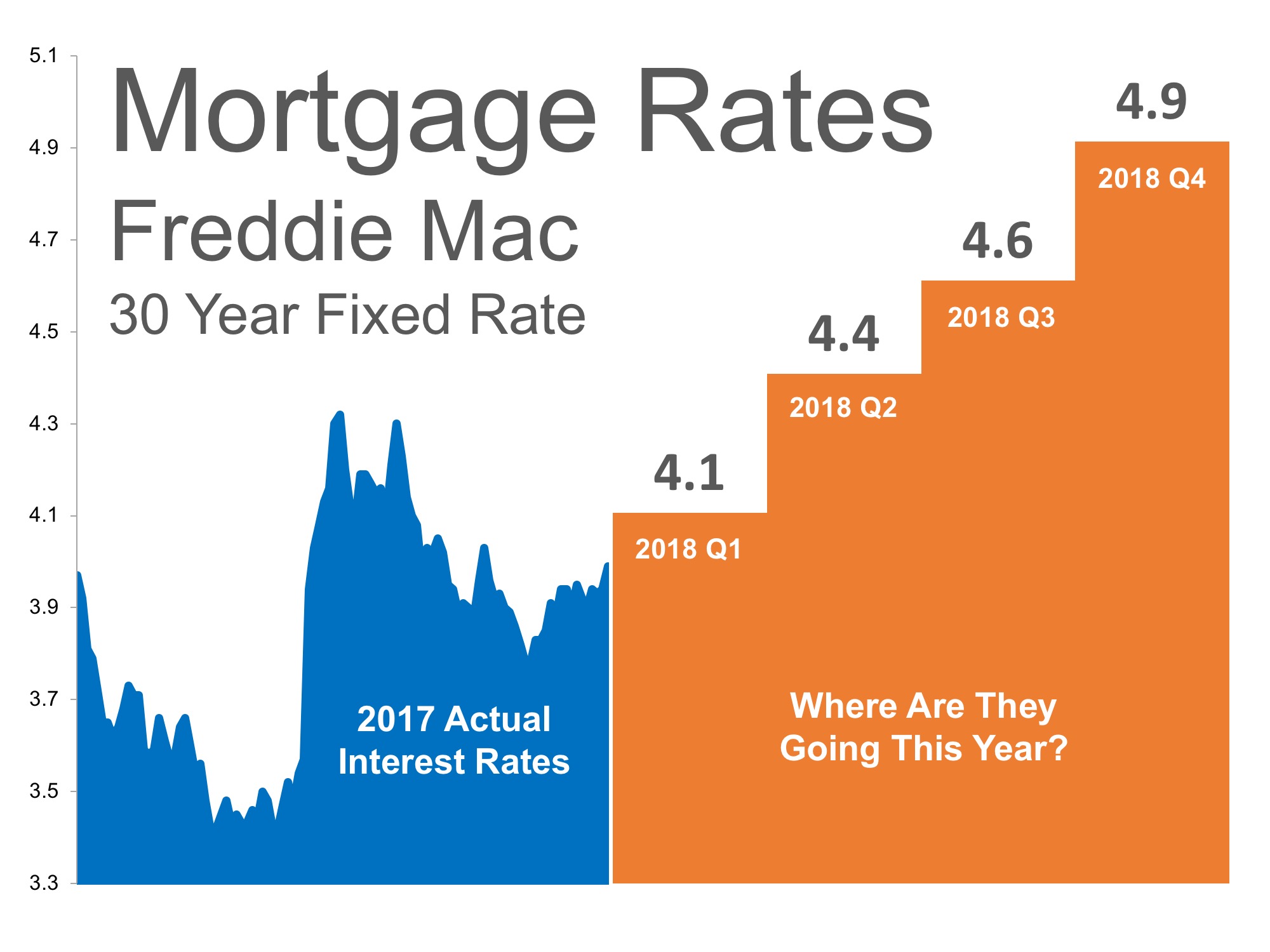

Below is a chart created using Freddie Mac’s U.S. Economic & Housing Marketing Outlook. As you can see, interest rates are projected to increase steadily over the course of the next 12 months. And while these are only projections and not a certainty, many financial professionals do believe rates will continue to go up this year.

How Will This Impact Your Mortgage Payment?

Depending on the amount of the loan that you secure, a half of a percent (.5%) increase in interest rate can increase your monthly mortgage payment significantly. On a $350,000 purchase with 20% down, your monthly payment will be almost $100 more per month for a loan at 4.75% versus 4.25%. And if you put less down, your costs will be higher.

According to CoreLogic’s latest Home Price Index, national home prices have appreciated 7.0% from this time last year and are predicted to be 4.2% higher next year. In Kitsap County, values have increased even faster.

If both the predictions of home price and interest rate increases become reality, families could wind up paying considerably more for their next home. For those who are ready, buying now, before rates and values increase, makes sense. But what if you’re not ready?

Are Rising Rates Really A Cause For Concern?

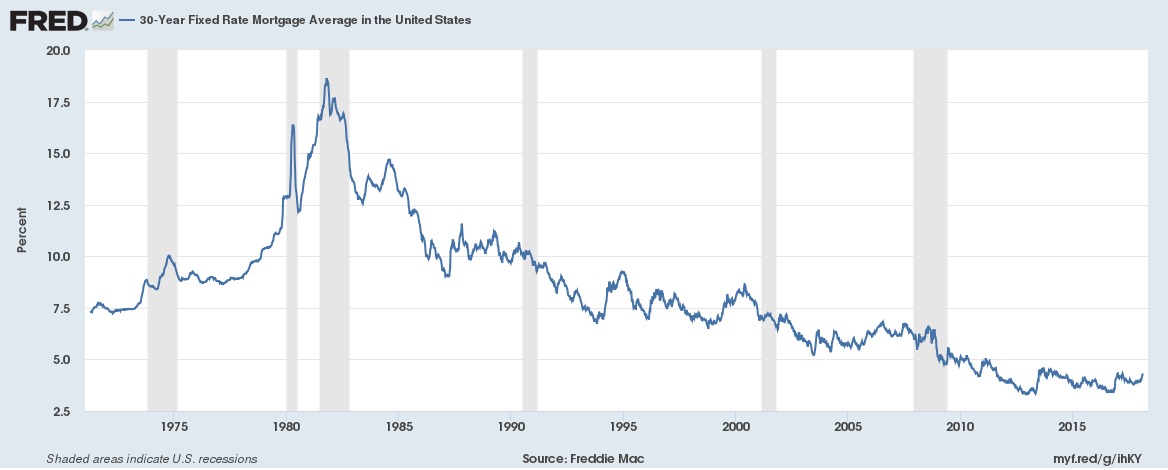

While increasing home values and rising interest rates impact purchasing power, the cost of borrowing money should be kept in perspective. Below is a chart that shows 30-year fixed rate mortgage rates over time. Note that we have had and continue to maintain historically low mortgage rates over the past 10 years. From the 1970’s through the early 2000’s, rates were, on average, above 6.5%. A small rise in interest rates now will still keep rates at historically low levels and should not be a cause for concern. In fact, if a rise in rates helps moderate demand and slows the rise in home values, that can help to keep the cost of purchasing a home within the reach of more buyers.

Bottom Line

An increase in interest rates this year, coupled with rising home values, could impact your family’s wealth. Would you like to know more? Let’s get together and talk about strategies for your future. Do you have questions? Please ask. I’m here and happy to help!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link