Between Friday of last week and Monday morning, interest rates rose a quarter of a point. Will they stay higher? I don't know. But when mortgage interest rates begin to climb, experts immediately begin to discuss home affordability indexes. They calculate how an increase in rates will slow home purchases as more and more potential buyers are priced out of the market. Today, with home prices also increasing, many believe that home sales may slow down rather dramatically.

This may prove to be true in the long term, particularly if both rates and prices continue to climb. However, in the short term, increasing mortgage rates may have just the opposite effect. Many buyers who have been sitting on the fence (and perhaps you are one of them) may realize that delaying their purchase no longer makes sense.

Last week, in a CNBC article, Matt Weaver of Florida-based PMAC Lending explained the impact an increase in rates will have:

"These increases really help the home-buying market. It really gets buyers to really understand that 'wait a minute, rates are at an all-time low, let's react now, let's react before they go higher’.”

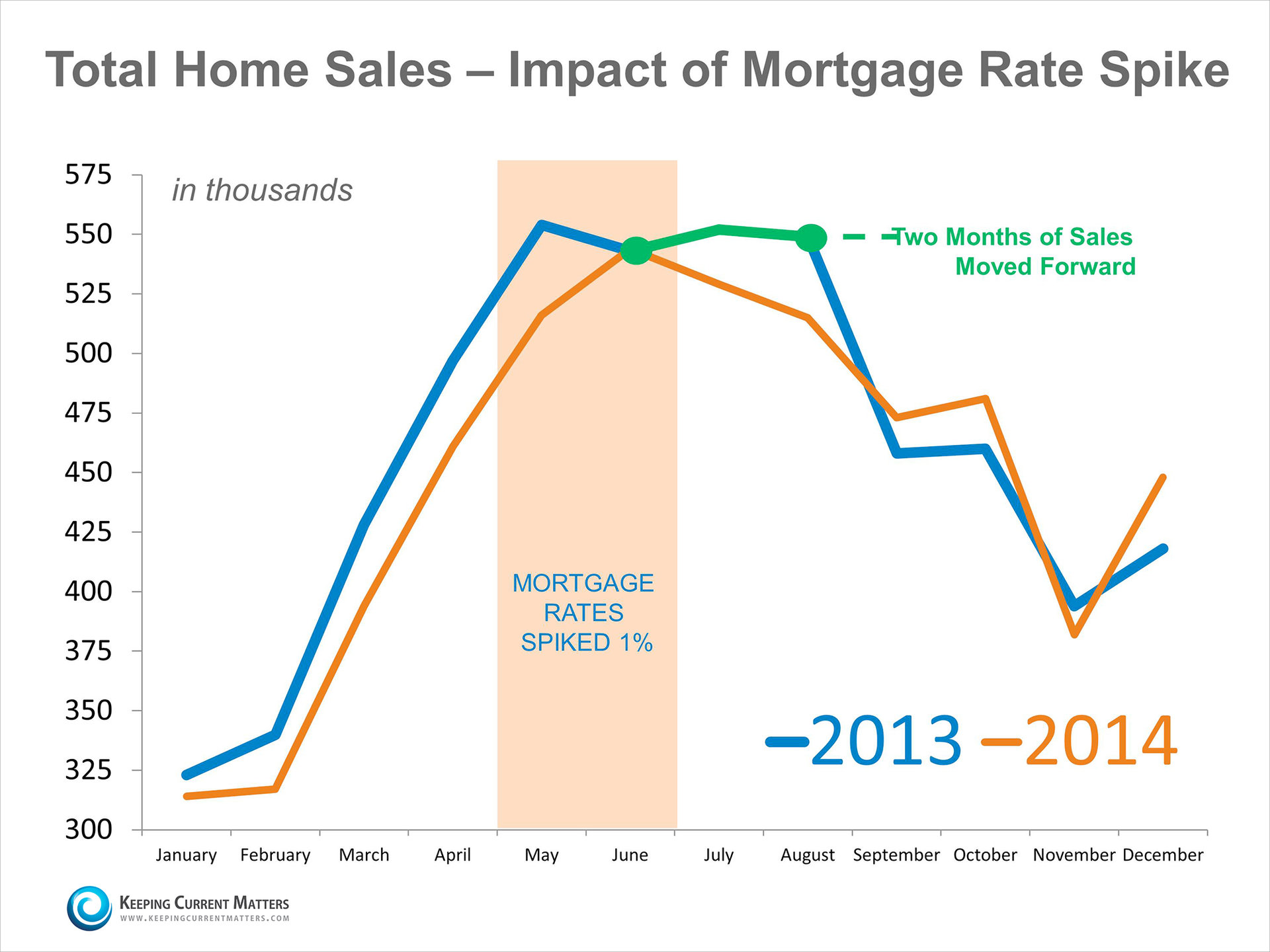

As an example, we can look to 2013 (in blue below compared to 2014 in gold) when interest rates spiked up by a full percentage point over a two month period. The result is that many buyers rushed to the market in the fear that rates would continue to climb. It didn’t necessarily dramatically increase the overall number of sales that year. However, you can see that the immediate response to a rise in rates was an increase in home sales as evidenced by the chart below. (The following drop in sales for both years is consistent with typical home sales cycles where things tend to slow down during the holiday season.)

We can also see that the sales cycle deviated somewhat in 2014 with more sales being pushed into July and August and slightly fewer sales in September and October than in the previous year.

Bottom Line

If you are waiting to put your house on the market, you might want to think twice. Now may be the perfect time to sell as rate increases create buyer competition that will continue to heat up as more purchasers jump into the market. Should you be considering a move, you may also save a on the monthly mortgage payment of your next home by selling now before rates go even higher. And, as always, if you have questions, please don't hesitate to ask. I'm always glad to help!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link